By Pavel Stich / COPYWRITER & SEO SPECIALIST

Last Updated: January 2026

When you are facing a financial emergency, your first instinct is often to look for help close to home. You open Google Maps and type “personal loans near me,” hoping to find a friendly face at a local branch who can hand you a check. It is a natural reaction; we tend to trust people we can see over algorithms we cannot.

However, the lending landscape of 2026 has radically shifted.

Applying does NOT affect your credit score!

While local branches still exist, the rise of AI-driven fintech and instant online lending has made the “face-to-face” loan application largely obsolete—and often more expensive. By limiting your search to lenders within a 5-mile radius, you might be missing out on lower rates, higher approval odds, and significantly faster funding speeds available online.

In this ultimate comparison guide, we dissect the pros and cons of walking into a local branch versus applying on your phone. We analyze credit unions, banks, predatory storefronts, and online marketplaces to determine definitively: Is it better to get a loan in person or online in 2026?

The 2026 Lending Landscape: A Tale of Two Options

Before we compare them, we must define who exactly you are finding when you search for lenders.

1. The “Local” Option (In-Person)

When you search for “personal loans near me,” Google Maps typically shows three types of businesses:

- Traditional Banks: Big names like Chase or Wells Fargo.

- Credit Unions: Member-owned non-profits (e.g., Navy Federal, Local Teachers CU).

- Storefront Finance Companies: High-interest lenders (e.g., OneMain Financial, TitleMax, Check ‘n Go).

2. The “Online” Option (Digital)

These are companies that exist primarily on your screen.

- Direct Online Lenders: Fintech companies like SoFi, Upstart, or Upgrade.

- Marketplaces: Platforms that let you check rates from 20+ lenders at once.

- Apps: Cash advance tools that bridge small gaps.

Head-to-Head Comparison: Local vs. Online

To make an informed decision, you need to see the data. Here is how the two options stack up in the current 2026 market.

| Feature | Local Lenders (In-Person) | Online Lenders (Digital) |

| Speed to Cash | 2–7 Days (Banks/CUs) <br> Instant (Storefronts) | Same Day to 24 Hours |

| Interest Rates | Lower (Credit Unions) <br> Very High (Storefronts) | Competitive (Market-based) |

| Convenience | Low (Requires travel/appointments) | High (Apply from couch) |

| Approval Odds | Strict (Banks) <br> Lenient (Storefronts) | High (AI Underwriting) |

| Documents | Physical Paperwork often needed | 100% Digital (Plaid connection) |

| Human Element | Face-to-Face Negotiation | Chatbots & Phone Support |

The Verdict:

If you want lowest rates and have time to wait, a local Credit Union is often best.

If you want speed and ease of approval, Online Lenders are superior.

Applying does NOT affect your credit score!

Deep Dive: The Case for Local Lenders

Despite the digital boom, there are valid reasons to visit a branch.

1. Credit Unions: The Gold Standard of Local Lending

If you have a relationship with a local credit union, this should be your first stop. Because they are non-profits, their interest rates are capped federally (usually at 18% or 28% for short-term loans).

- The Human Touch: A loan officer at a credit union can look you in the eye and listen to your story. If your credit score is 580 but you have held the same job for 10 years, they might override a denial.

- The Downside: You must be a member. Furthermore, their technology lags behind. You might have to fax documents or wait days for a committee to review your file.

2. Traditional Banks: The Strict Gatekeepers

You might see a Chase or Bank of America on every corner, but walking in for a personal loan is often futile. As we discussed in our analysis of Does Bank of America Offer Personal Loans?, big banks have largely exited the personal loan market for bad credit borrowers.

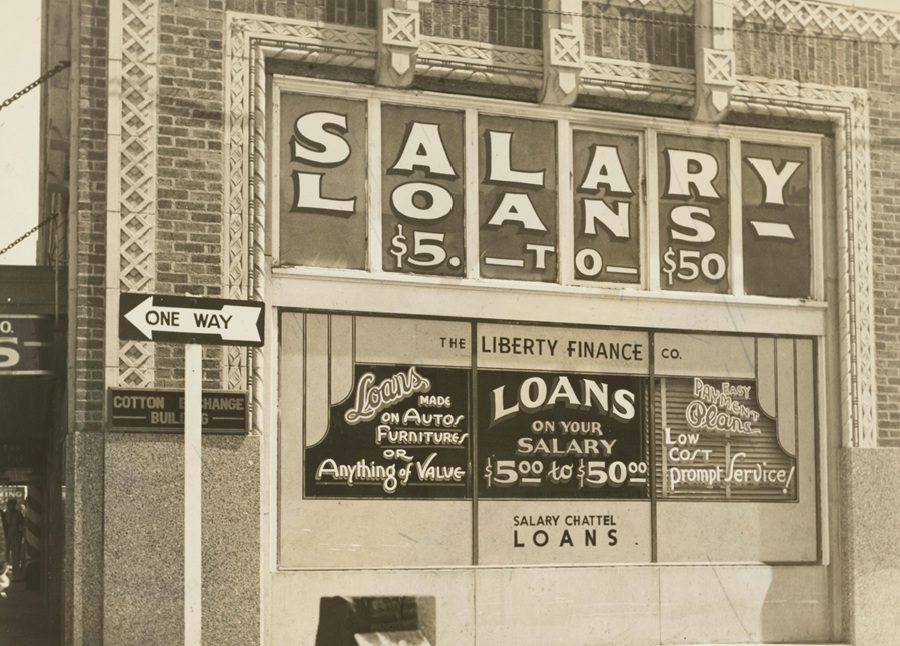

3. The “Near Me” Trap: Predatory Storefronts

Warning: Most results for “loans near me” are not banks. They are predatory payday and title loan stores.

- The Risk: These places offer instant cash, but they charge 300%+ APR.

- The Reality: You walk out with cash, but you sign a contract that traps you in debt for years.Need instant cash safely? Don’t go to a storefront. Read: I Need a Payday Loan Immediately: 5 Safe Ways.

Deep Dive: The Case for Online Lenders

In 2026, over 70% of personal loans in the US are originated online. Here is why the shift has happened.

1. AI-Driven “Instant” Approvals

Online lenders utilize Artificial Intelligence. Instead of a human reviewing your pay stubs, an algorithm scans your bank data (via Plaid) and credit file instantly. This allows for approval decisions in seconds, not days.

See who approves fastest: Easiest Personal Loans to Get Approved For.

2. Soft Credit Checks

When you walk into a bank, they typically run a “Hard Pull” on your credit just to give you a quote. This hurts your score.

In contrast, online marketplaces allow you to pre-qualify with a “Soft Pull.” You can compare rates from 10 different lenders without damaging your credit score.

3. Specialized Lending for Bad Credit

Local banks usually have a “cutoff” score (e.g., 660). Online, there are specialized lenders for every credit tier.

- Score 600-660: Upgrade, Avant.

- Score < 600: OppLoans, Upstart.Explore options: Best Personal Loans for Bad Credit.

Applying does NOT affect your credit score!

What Does Reddit Say? (Real User Experiences)

We analyzed thousands of discussions on r/personalfinance and r/borrow regarding the “local vs. online” debate in 2026.

- The Consensus: Reddit users overwhelmingly advise avoiding storefront lenders found on Google Maps. The horror stories of 400% interest rates are common.

- The Strategy: Most savvy users recommend checking your local Credit Union first. If they are too slow or deny you, they suggest moving immediately to reputable online lenders like SoFi or LightStream.

- The “Local” Trick: Some users note that for “No Credit Check” needs, small local credit unions offer Payday Alternative Loans (PALs), which are the only safe “local” bad credit option.

Decision Matrix: Which Path Should You Choose?

Still undecided? Use this checklist to determine the best route for your specific situation.

Go Local (In-Person) If:

- You are already a member of a Credit Union.

- You have a complex income situation (paid in cash) that requires explanation.

- You are not comfortable uploading banking passwords online.

- You want to use collateral (like jewelry) at a pawn shop for a small amount.

Go Online If:

- You need the money tomorrow or today. Check speed: Best Emergency Personal Loans Fast Funding.

- You want to compare multiple rates to ensure you aren’t being overcharged.

- You have bad credit and want to avoid the embarrassment of face-to-face rejection.

- You want to consolidate debt directly (some online lenders pay your creditors for you).

Learn how: Best Personal Loans for Debt Consolidation.

Step-by-Step: How to Apply Online (The Faster Way)

If you decide that online is the better path, the process in 2026 is streamlined.

- Check Your Rate: Use a comparison site to enter your info once. This triggers a soft credit check.

- Select the Best Offer: Look at APR, not just the monthly payment.

- Verify Income: Link your bank account digitally. This verifies your income instantly without uploading PDFs.

- Sign and Fund: Sign the e-contract on your phone. If done before 10 AM, funds often arrive by 5 PM.

Self-Employed? Online lenders are much better at verifying gig economy income than local banks. See: Best Personal Loans for Self-Employed.

Frequently Asked Questions (FAQ)

For most people in 2026, online is better due to speed, the ability to compare rates, and soft credit checks. However, in-person is better if you qualify for a low-interest loan at a local Credit Union or if you have a complicated financial situation that requires human discretion.

An unsecured, fixed-rate installment loan is the best type. Avoid “title loans” or “payday loans” found at local storefronts, as these are predatory. Both online lenders and credit unions offer safe installment loans.

Only if you have excellent credit (700+) and are an existing customer. Banks often offer “relationship discounts” (e.g., 0.25% off interest). However, if you have bad credit, your bank will likely deny you, making online lenders the better choice.

Yes. Applying causes a small, temporary dip (due to the hard inquiry). However, making on-time payments on a personal loan builds your credit history significantly. Furthermore, using a loan to pay off credit cards can lower your utilization, boosting your score.

You should never use a loan shark. Illegal lenders operate outside the law and can be dangerous. If you are desperate, look for “No Credit Check” options that are legal and regulated.

Safe alternatives: Small Payday Loans Online: No Credit Check.

Final Verdict

The search for “personal loans near me” is understandable, but often outdated. In 2026, the best financial products are rarely found in a strip mall.

While local Credit Unions remain a fantastic resource for low rates, the Online Lending ecosystem offers superior speed, convenience, and accessibility for the average American—especially those with less-than-perfect credit.

Don’t limit your options to a 5-mile radius. Expand your search online to find the lenders who actually want your business.

Applying does NOT affect your credit score!

Disclaimer: CashLendy.com is an independent financial publisher. We compare legitimate lenders. We advise users to avoid unlicensed storefronts and predatory lenders often found in local “near me” searches.